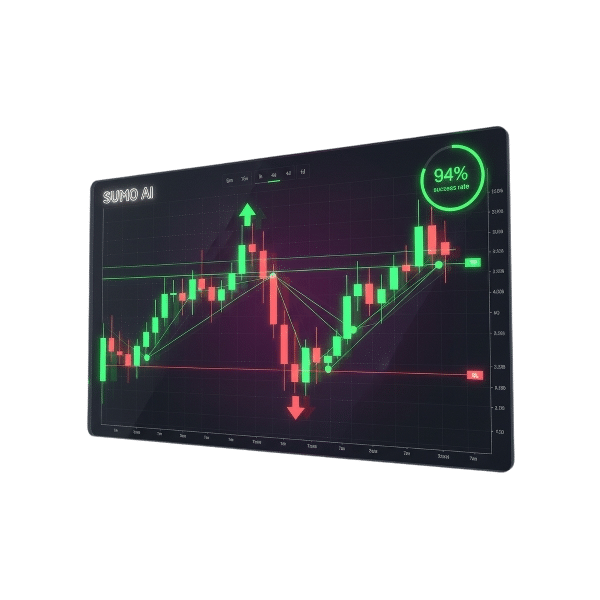

Crypto Trading Platform. Sumo handles the analysis, You focus on results.

LLM-based engines analyze thousands of markets 24/7, transforming raw volatility into clear, risk-aware trading ideas. This process relies on advanced crypto technical analysis, combined with actionable real-time crypto signals designed for fast execution. By leveraging a precise multi-timeframe trading approach and disciplined TP/SL optimization, you can execute trades within minutes—without spending hours watching charts.

Structured, risk-aware plans instead of random alerts.

Instead of raw signals or noisy indicators, Sumo delivers complete trade plans – entries, stops, and targets – that plug directly into how you already trade.

AI-powered analysis

Advanced LLM analyzers read market structure, volatility, and sentiment so you don’t have to. Each setup is scored for quality before it ever reaches your screen.

Learn moreMulti-timeframe logic

Dedicated engines for 5m, 15m, 1h, 4h, and 1d keep your entries aligned with the dominant trend – from fast scalps to patient swing trades.

Explore timeframesRisk-first execution

Every idea ships with AI-calculated TP & SL levels, built around ATR and structure to avoid random stop-outs and emotional exits.

See TP/SL engine

How different traders plug Sumo into their routine.

Whether you scalp during volatility spikes or check charts twice a day around a full-time job, Sumo slots into the time you actually have – without asking you to trade like someone else.

The day-job swing trader

Checks Sumo morning and evening, focusing on 4h and 1d swing ideas that don’t demand constant attention.

✓ Scan 1d trend & 4h entries over coffee.

✓ Place orders with pre-defined TP/SL.

✓ Review once after work.

The intraday scalper

Lives on 5m and 15m signals with alerts and bots handling execution, while Sumo’s risk framework keeps position sizing in check.

✓ Real-time short-horizon alerts.

✓ Tight stops & staged exits.

✓ 1h trend filter to avoid fighting the move.

The system builder

Uses Sumo’s entries, TP, and SL levels as a core engine, then connects via API or bot to layer on custom rules and automation.

✓ Structured signals as raw material.

✓ API-ready levels for bots.

✓ Scales strategies without reinventing the wheel.

Our software is available on every device.

Trade from the screen that fits your life – iOS, Android, desktop, or web. Sumo syncs your plans so you can act on high-quality signals wherever you are.

−What instruments and timeframes are supported?

+Are the signals automated trading?

+How do you handle risk management?

+Can I try it before paying?

- Bitcoin traders eye Iran reactions as oil sparks US 5% inflation forecast

- Bitcoin recovers to $68K following death of Iranian Supreme Leader

- Bitcoin bottom fractal calls for 130% rally, but is the model valid in 2026?

- Buying Bitcoin? Hold for at least three years to avoid losses, data says

- Bitcoin price drops to $63K as US, Israel launch airstrikes on Iran

- Mt. Gox’s former CEO floats hard fork to recover 80K hacked Bitcoin

- Bitcoin price slump versus gold’s gains highlights evolving crypto market

- Three Solana data points highlight resilience, but is SOL undervalued?

- DCTRL Vancouver: Iconic Bitcoin Hackerspace Closes Downtown Location After 12 Years Due to Zoning Changes

- Traders may rotate into Bitcoin if UBS’ bearish US stocks view comes true

- Senate Democrats Press DOJ, Treasury to Probe Binance Over Trump Ties, Iran Sanctions Allegations

- Sora Ventures-Backed Bitplanet Reaches 300 Bitcoin, Ranks Among Asia’s Top 20 Corporate Holders

- Bitcoin manipulation claims face pushback as ETFs snap 5-week outflow run: Finance Redefined

- U.S. Government Seizes Over $580 Million in Crypto Linked to Southeast Asian Scams

- MARA Holdings (MARA) Stock Jumps After $1.71B Loss as Firm Pivots to AI Data Centers

- Paul Atkins Confirmed As A Bitcoin 2026 Speaker

- Block (XYZ) Surges 25% After Slashing Workforce by Over 40% and Raising Profit Outlook

- The Core Issue: libsecp256k1, Bitcoin’s Cryptographic Heart

- Citi to Integrate Bitcoin with Traditional Finance, Launch Custody Services

- Indiana Approves Bitcoin Investments in Public Retirement Plans

Start small, scale when you see the edge.

Run Sumo alongside your current workflow for seven days. When you’re ready, upgrade into the plan that matches your trading style – monthly, yearly, or lifetime.

Trading cryptocurrencies involves significant risk and may not be suitable for every investor. Sumo provides structured analysis and trade plans, but cannot guarantee profits or prevent losses. Only trade with capital you can afford to lose.